Money, Banking, and Markets – Connecting the Dots

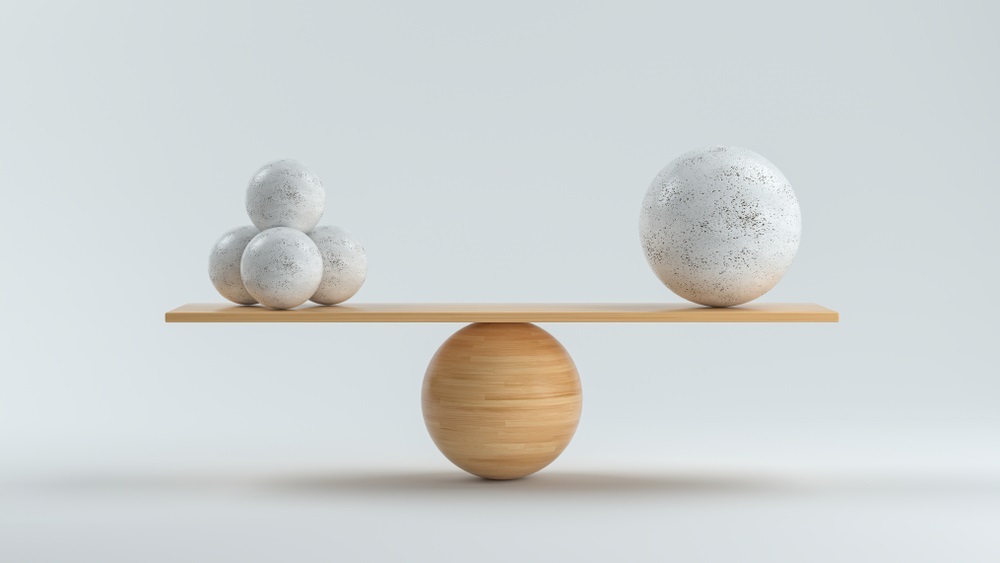

The greater the misalignment between financial quantities and economic quantities, the more distorted and grotesque the whole picture becomes, particularly if nobody carefully connects the dots. Unfortunately, investors and policy makers repeatedly insist on learning that the hard way.