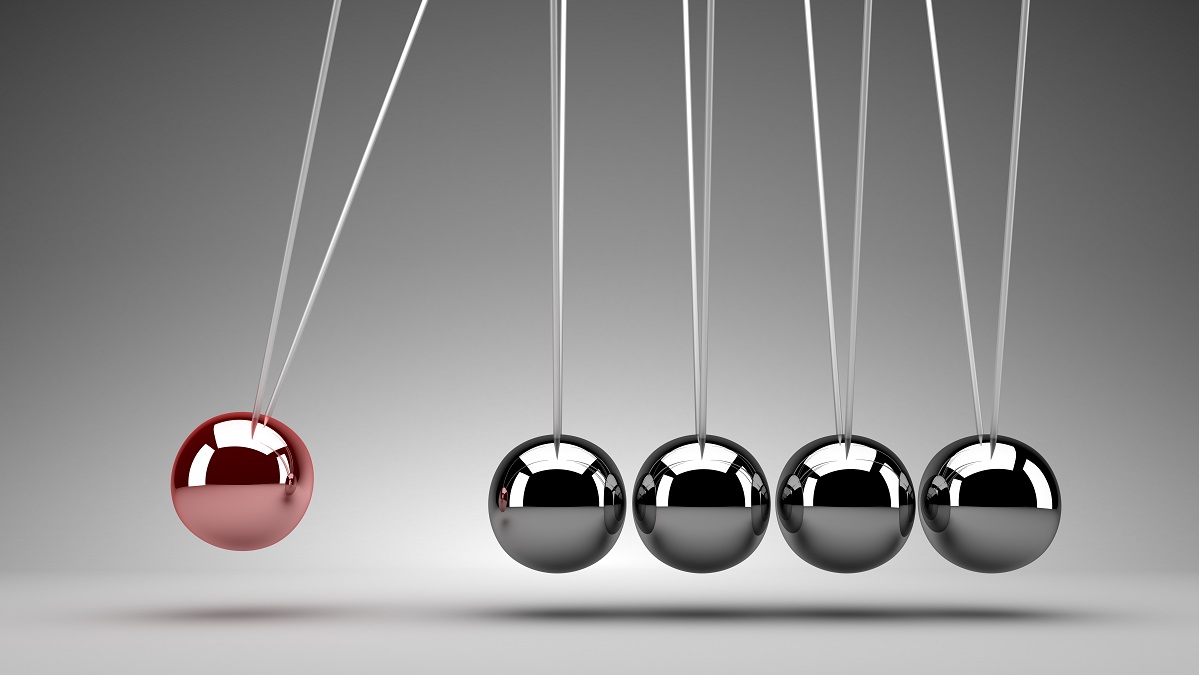

Maladaptive Beliefs

There’s no question that persistently deranged and activist Federal Reserve policy has required investors to adapt. But the form of that adaptation is crucial. The thing that 'holds the stock market up' isn’t zero-interest liquidity, at least not in any mechanical way. It’s a particularly warped form of speculative psychology that rules out the possibility of loss, regardless of how extreme valuations have become.